Minshen Shares Awarded Top 10 Pressure Sensor and Acceleration Sensor Companies in China 2023

5 Day, The 2023 World Sensor Conference was grandly held in Zhengzhou, Henan. As a high-level industrial event in China's sensor industry, it has attracted much attention from the industry and all sectors.

At the summit, CCID Consulting, an industry research institution directly under the Ministry of Industry and Information Technology, released the 2023 White Paper on High-Quality Development of China's Sensor Enterprises, introducing the latest industrial situation of China's sensors, and respectively announcing the list of top ten pressure sensor enterprises and top ten acceleration sensor enterprises in 2023. Minxin Shares, relying on years of technological accumulation and leading advantages in the MEMS field, was selected for both lists.

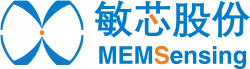

According to data from CCID Consulting, In 2022, the global sensor market size was US$184.05 billion (approximately RMB 1340.49 billion), and the global smart sensor market size was US$43.29 billion (approximately RMB 315.29 billion). In 2022, the size of China's sensor market was 309.69 billion yuan, and the size of China's smart sensor market was 119.02 billion yuan.

▲Source: CCID Consulting

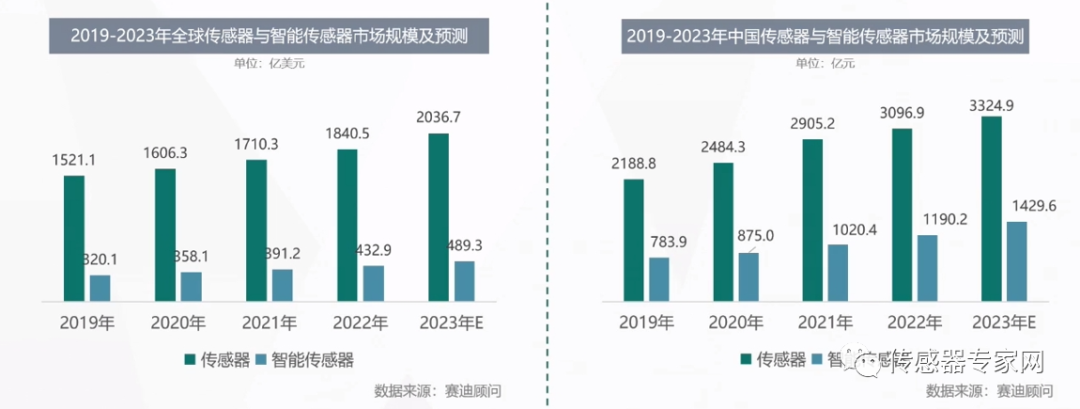

Among them, specifically in various sensor segments, Pressure sensors are the largest single market segment in China's sensor industry. , Sales in 2022 reached 58.86 billion yuan, accounting for 18.6%; image sensors ranked second, reaching 41.34 billion yuan, accounting for 13%; and position sensors ranked third, reaching 32.11 billion yuan, accounting for 10.1%. 。

Pressure sensors have ranked first in the annual data on the size of China's sensor market, with downstream application areas such as consumption, industry, agriculture, medical care, and automobiles all having a large demand for pressure sensors. Pressure sensors are also among the earliest to use MEMS process manufacturing sensor products. In 2022, the size of China's pressure sensor market was 58.86 billion yuan, with a growth rate of 6.5%, and it is predicted that the size of China's pressure sensor market in 2023 will be 64.68 billion yuan, with a growth rate of 9.9%.

▲Source: CCID Consulting

Acceleration sensors are widely used in automobiles, high-speed rail, drones, wearable devices, medical care, and other fields. Among them, the accelerometer is the first truly mass-produced commercial application of MEMS sensors, invented by Analog Devices, Inc. (ADI) in 1991, used in collision sensing for airbag control. Currently, many MEMS sensor companies have acceleration sensor products, with mature and stable processes and products.

In 2022, the size of China's acceleration sensor market was 20.49 billion yuan, with a growth rate of 5.2%, and it is predicted that the size of China's acceleration sensor market in 2023 will be 22 billion yuan, with a growth rate of 7.4%.

▲Source: CCID Consulting

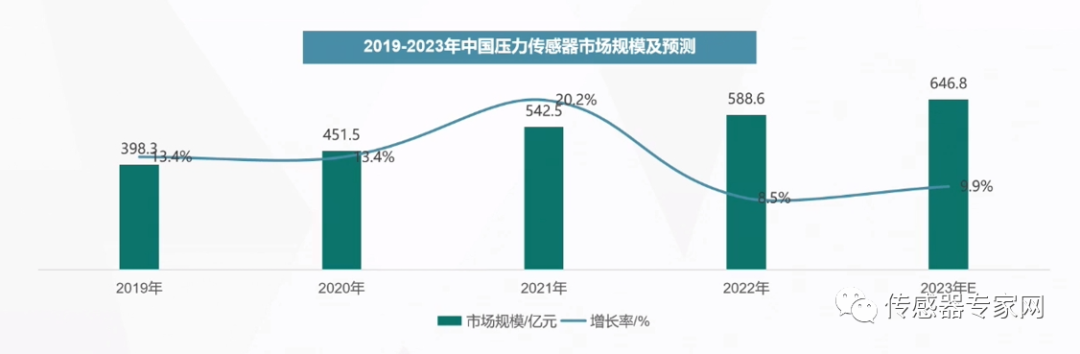

Based on market competitiveness, growth, application cooperation, market promotion, technical strength, and development potential, etc. 6 major categories of indicators and 29 secondary indicators, CCID Consulting selected the list of top ten enterprises in China's pressure sensors and acceleration sensors in 2023.

CCID Consulting believes that the evaluation index system basically covers all the contents of the competitiveness of the sensor industry, and can illustrate the current and future development level of enterprises, comprehensively reflecting the size of the industrial competitiveness of various enterprises.

▲Source: CCID Consulting

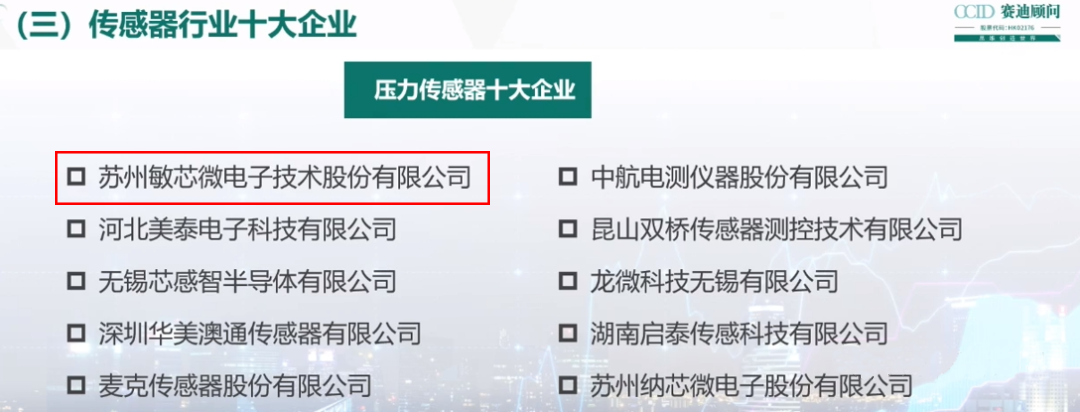

The top ten Chinese pressure sensor companies in 2023 are as follows:

▲Source: CCID Consulting

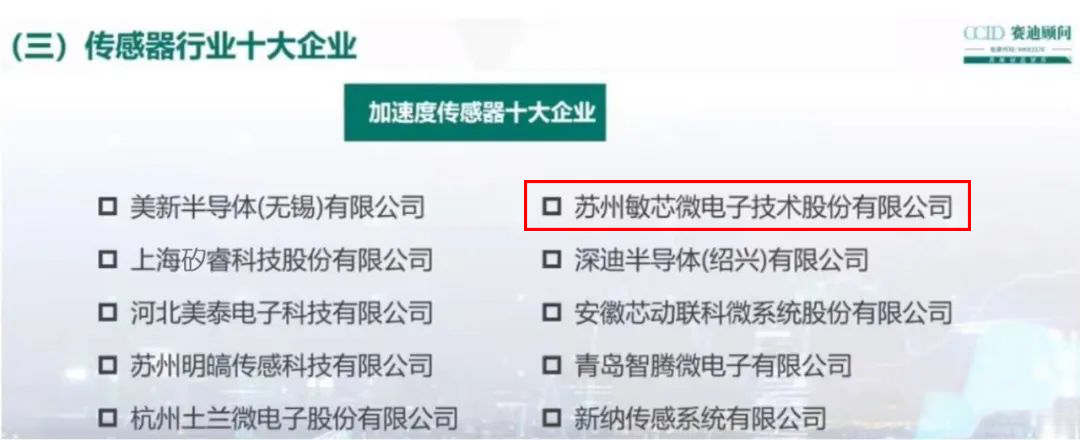

The top ten Chinese acceleration sensor companies in 2023 are as follows:

▲Source: CCID Consulting